Navigating Commercial Real Estate in Economic Turbulence

Welcome to Resolute’s CRE Compass! Each quarter, we will bring you the latest insights and updates on the dynamic world of commercial real estate (CRE). As industry leaders in managing distressed assets, Resolute is committed to providing you with expert analysis, success stories, and strategic guidance to help you navigate these challenging times. In this Summer 2024 issue, we delve into the pivotal role of receiverships in addressing economic turbulence, focusing on actions that stabilize and revitalize distressed CRE assets. With over 300 successfully managed real estate cases and $7 billion in distressed assets across 36 states, Resolute’s expertise is here to help you achieve your property goals.

The Rising Tide of Bankruptcies and its Impact on Commercial Real Estate

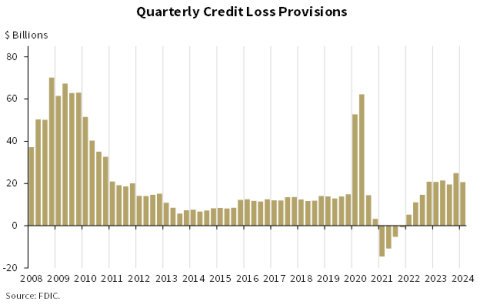

The recent uptick in bankruptcy filings, notably a 16 percent increase in the year ending March 2024, has sent shockwaves through various sectors, with commercial real estate feeling a pronounced impact. This surge, aligning with a similar acceleration noted in the latter part of 2023, has placed numerous properties in precarious positions, particularly as business filings rose by 40.4 percent. This trend underscores a pressing need for strategic interventions to safeguard value and operational continuity in the CRE sector.

Understanding the Role of a Receiver in Commercial Real Estate

In the realm of commercial real estate, a receiver acts as a court-appointed custodian tasked with managing and stabilizing distressed properties. This role is multifaceted, encompassing the execution of new leases, authority to grant tenant rent relief, collection of rents, and overseeing day-to-day property management. Additionally, the receiver plays a crucial role in addressing deferred maintenance and correcting life safety issues, ensuring the property remains viable and compliant.

The Strategic Steps in Overseeing Distressed Properties

Receivership entails a series of strategic steps aimed at preserving and enhancing the value of distressed properties. This process begins with a thorough assessment of the property’s current standing, followed by the implementation of measures to improve operational efficiency, reduce costs, and enhance revenue generation. Receivers have the authority to renegotiate leases, offer rent relief to viable tenants, and engage in proactive property management to attract and retain tenants, thereby stabilizing the asset.

Success Stories

Our track record at Resolute speaks for itself. Here are a few examples of how our real estate services have made a difference:

- Veranda at Ventana: Appointed as the receiver for a Class A condo conversion, we expertly managed 113 rentable units across 42 garden-style buildings. This project involved navigating the complexities of mixed ownership and tenancy, enhancing the property’s value and stability for future transactions. Our efforts ensured that the project was positioned for long-term success, benefiting both the owners and the tenants.

- Offices at Pinnacle Peak: This 220,000 sqft office development in Scottsdale, Arizona, was abandoned at 30% completion due to financial default. As the appointed receiver, our team reengaged contractors, managed new budgets, and timelines with lender’s capital, leading to the completion of the development. The successful sale not only recovered the defaulted loan but also generated additional capital, demonstrating our ability to turn around stalled projects.

- Lake Pleasant Heights: We were appointed as the receiver for 792 acres of a larger 3,200-acre master-planned community. This project involved a complicated loan structure with multiple stakeholders. Our team managed the ongoing entitlement process, protected the property’s interests, and preserved its value. The project showcased our ability to handle complex real estate challenges and deliver results that meet our clients’ needs.

- PDG Portfolio: The PDG Portfolio presented a significant challenge with an original loan balance of $212 million. This portfolio once included 11 retail properties in Arizona, totaling 1.5 million square feet. Over time, most of these properties became real estate-owned (REO), with only one property remaining unresolved. As the receiver, Resolute managed the liquidation process, achieving net proceeds of $13.6 million despite the liquidation expenses of $19.7 million. This case underscores our expertise in managing large-scale, distressed portfolios and mitigating financial losses.

Maximizing Property Value Through Receivership Sales

One of the receiver’s pivotal roles is to facilitate the sale of distressed properties, which can be instrumental in maximizing the asset’s value and mitigating financial losses. Receivership sales offer several advantages, including the ability to sell the property with assumable loans, thereby avoiding prepayment penalties or defeasance costs. By engaging in comprehensive marketing efforts and leveraging third-party brokers when necessary, receivers can drive competitive bidding processes, ultimately achieving the highest possible sales price for the property.

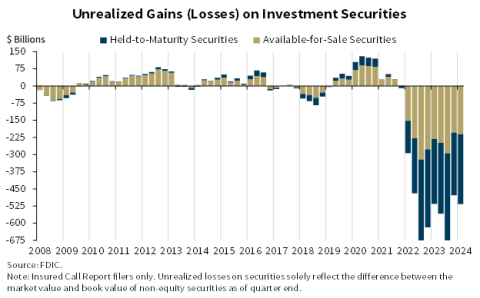

Challenges and Opportunities in Today’s CRE Receivership Landscape

The current economic downturn and the subsequent rise in CRE bankruptcies present both challenges and opportunities for receiverships. On one hand, receivers must navigate complex financial structures, legal intricacies, and operational hurdles to stabilize distressed properties. On the other hand, the current market dynamics offer unique opportunities for value creation through strategic management and disposition of assets. Receiverships can serve as a critical intervention mechanism, providing a pathway to recovery for properties that might otherwise face foreclosure or prolonged distress.

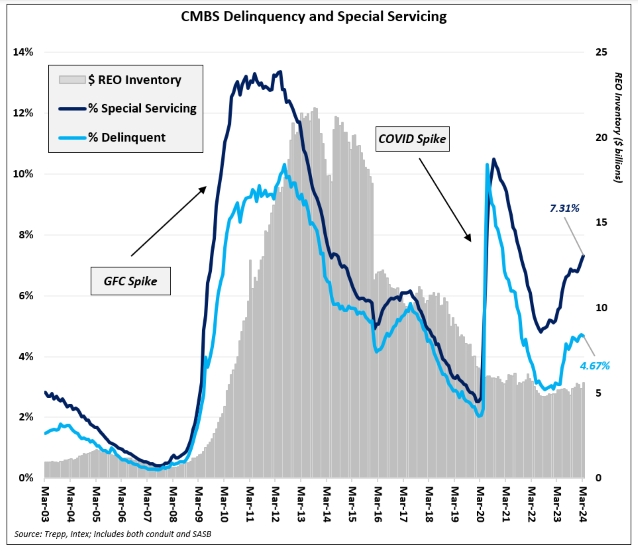

Future Outlook: Preparing for a Wave of CMBS Maturities

Looking ahead, the commercial real estate sector must brace for a significant wave of CMBS (Commercial Mortgage-Backed Securities) loan maturities, projected to peak in 2024. This impending wave, amounting to an estimated $500 billion, poses both risks and opportunities. For receivers, this scenario underscores the importance of strategic foresight and preparedness. By leveraging their expertise in managing distressed assets, receivers can play a pivotal role in navigating the challenges and seizing the opportunities presented by the maturing CMBS loans, ultimately contributing to the stabilization and revitalization of the CRE market.

Receiverships are not just a last resort but a powerful strategy for unlocking the potential of distressed real estate assets. By employing strategic management practices, engaging in proactive sales efforts, and navigating the complexities of distressed assets, receivers can help stabilize and revitalize properties, delivering value to stakeholders and contributing to the sector’s overall resilience. At Resolute, we are committed to delivering expert solutions that drive income, control expenses, and increase property value. Our proven track record and client-centric approach make us the go-to choice for resolving distressed commercial real estate assets.

Are you interested in exploring our commercial real estate services? Fill out the form below to schedule a consultation and discover how we can help you achieve your property goals.

Curious about Resolute’s Real Estate Team? Learn more here.

At Resolute, we recognize the critical importance of confidentiality when managing distressed assets. Our experienced team handles these sensitive matters with the utmost discretion, ensuring your information remains secure.