We’re thrilled to be back! Welcome to Resolute’s Restructuring on the Rocks” (RnR) — your go-to source for expert insights into the evolving landscape of financial restructuring. Through a blend of in-depth analysis and proprietary data, RnR offers a clear view of bankruptcy and receivership trends in Arizona and the broader Rocky Mountain West.

Each edition is crafted to support your professional needs, providing actionable information that enhances your strategies and decision-making. We also bring you the latest developments from Resolute, from groundbreaking tools to essential company updates, ensuring you stay ahead in your field.

Restructuring on the Rocks (RnR) is designed to guide and inform your practice, helping you navigate the complexities of today’s financial environments with confidence and clarity. Join us as we explore the critical issues that shape our industry and your success.

Neat Insights: Bankruptcy Trends in Arizona

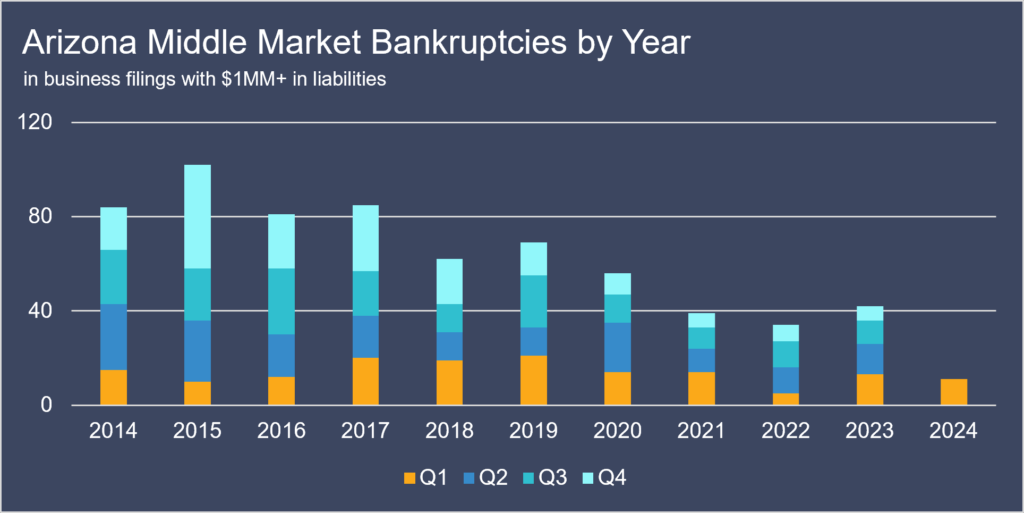

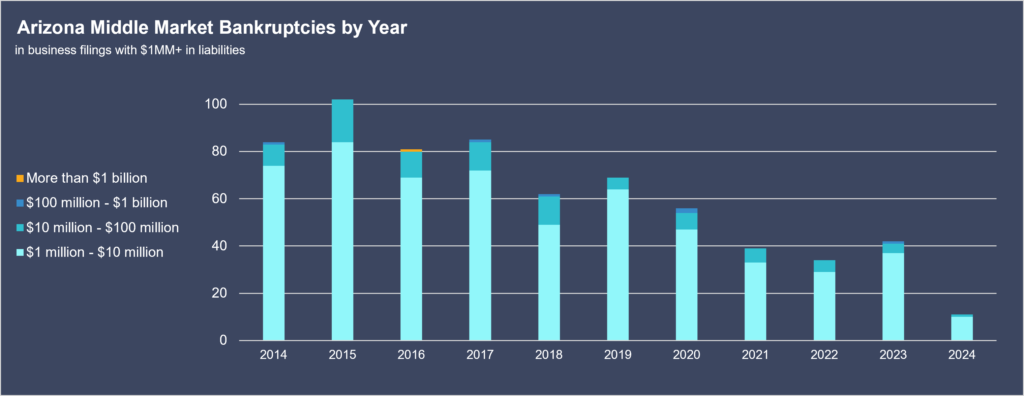

Fluctuations in middle market bankruptcies in Arizona from 2014 to the current date have several underlying reasons. Notably, many businesses operating within Arizona are incorporated in other states, leading to bankruptcy filings elsewhere. Post-COVID, financial support measures and a general willingness from lenders to work with borrowers have provided a buffer. Various repayment options and interest rate accommodations have been instrumental in this regard.

The observed decline in middle market bankruptcies over the years can be partially attributed to Arizona’s economic resilience, but other factors have played a significant role. Improved business conditions and low unemployment rates reflect an overall economic uptick. The data from 2014 and 2015 still showed the lingering effects of the 2008 recession, but a gradual recovery is evident in the subsequent years.

Peaks and Valleys: Bankruptcy Insights from the Rocky Mountain West

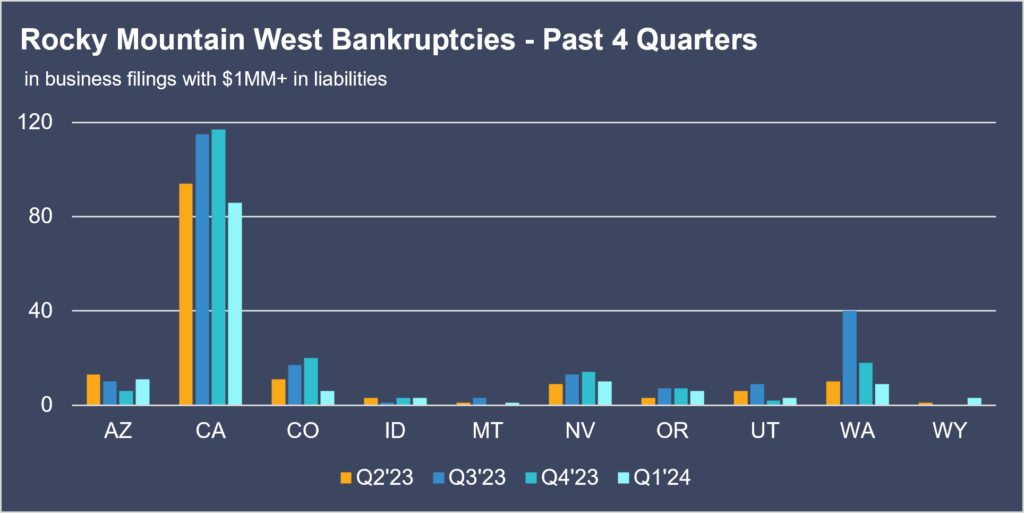

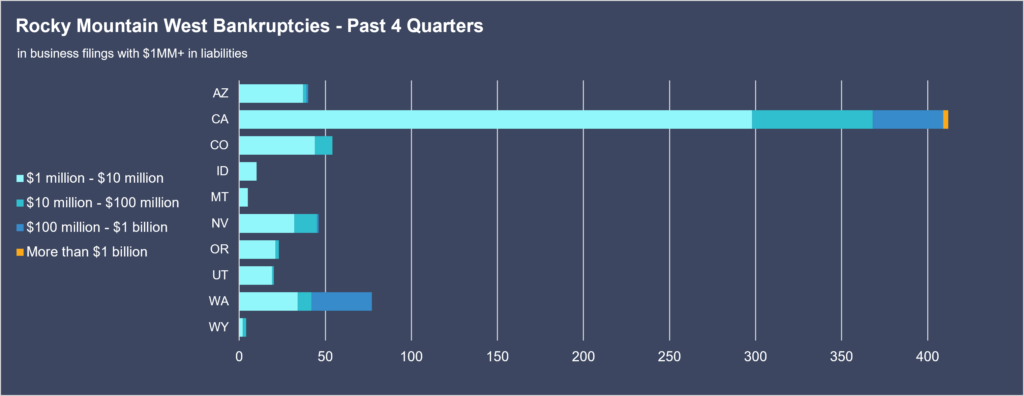

In the Rocky Mountain West, spikes in bankruptcy filings in certain quarters are likely reflective of broader economic shifts and regulatory changes. At Resolute, our approach to advising clients is to stay abreast of market trends. Looking ahead, we anticipate that high interest rates may keep distress levels elevated. However, the substantial capital present in the market is expected to aid in saving and revitalizing struggling companies. Venture capital investment has seen a decline, suggesting a tightening financial environment for new enterprises. High inventory levels accumulated during the pandemic—for goods like grills, televisions, and exercise equipment—indicate potential for increased distress in the near term.

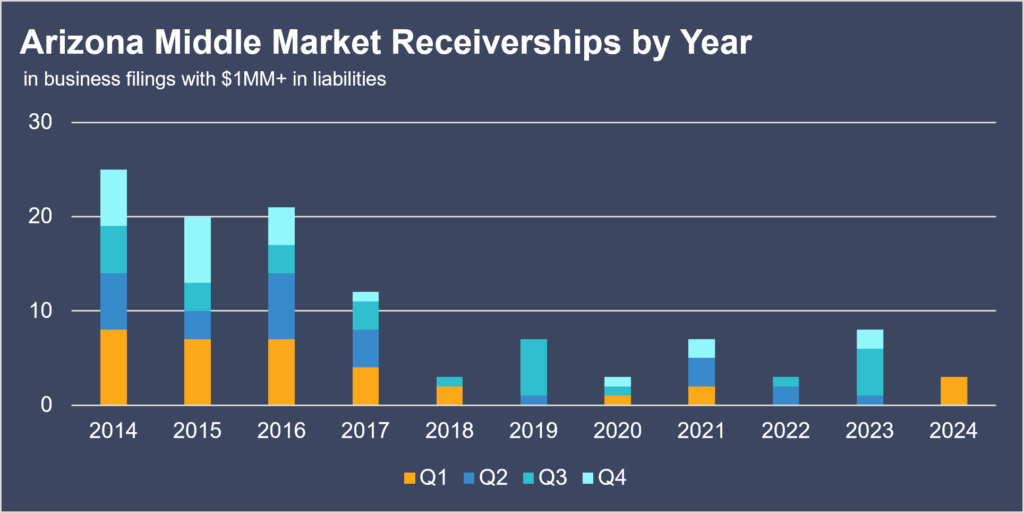

Arizona’s Receivership Trends

The receivership landscape in Arizona mirrors several trends seen in bankruptcy filings. The presence of external financial support and lender flexibility also applies to receivership scenarios, with a particular emphasis on the availability of various restructuring options.

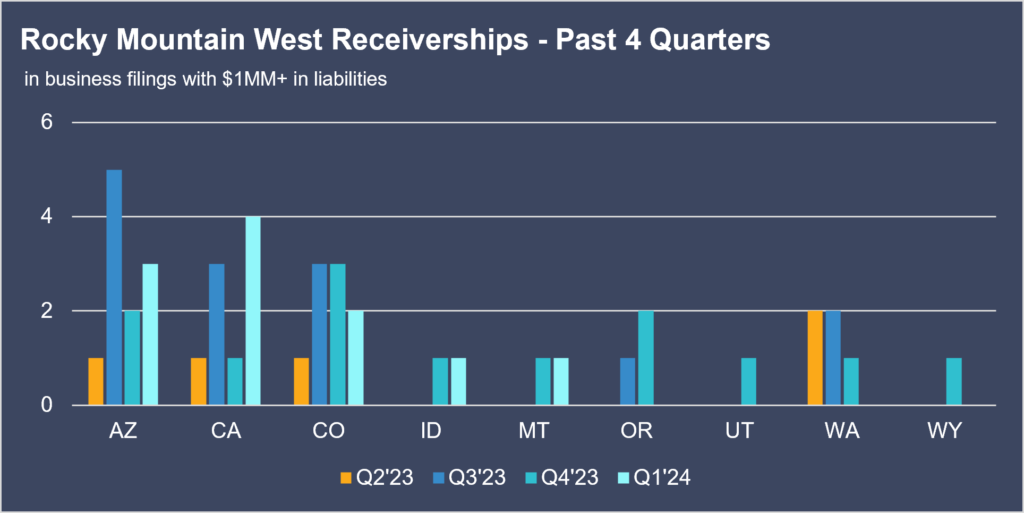

Distilled Dynamics: Receivership Trends in the Rocky Mountain West

Federal and state policies have notably impacted bankruptcy and receivership trends in the Rocky Mountain West. The introduction of Chapter 11 subchapter V filings has led to a significant increase in these types of filings post-COVID. This reflects a shift toward restructuring efforts that are more tailored to small business needs.

Changes within specific industries also resonate through the data. The cannabis industry, grappling with capital and banking constraints, faces unique challenges. The healthcare sector consistently faces troubles, often due to poor management. Startups, especially those not yet cash-flow positive, struggle to secure new capital, a situation exacerbated by the current venture capital retrenchment.

Expert Guidance in the Cannabis Industry: Meet Our Advisor, Kaiya

Meet Kaiya, Resolute’s Cannabis Industry Expert Advisor! With over a decade of leadership in regulated cannabis markets, Kaiya brings unparalleled expertise to elevate your investments. Our team, enriched with savvy finance professionals and seasoned industry experts, offers comprehensive support tailored to the unique challenges of the cannabis sector. Kaiya’s accomplishments include launching multiple brands and managing the production of millions of units, leveraging data-driven strategies and sustainable practices to drive significant operational efficiencies.

Resolute provides a full spectrum of services designed to optimize your cannabis business, from navigating financial complexities to strategic restructuring. Discover how our expert guidance has propelled businesses to industry-leading positions.

Ready to elevate your cannabis venture with expert insights?

Uncover Hidden Risks with Resolute’s Business Assessment Tool

Empower your lending decisions with our advanced tool that delivers crucial insights within just four weeks. Gain a deep understanding of your borrower’s financial health through meticulous analysis of financial statements, on-site inspections, and key interviews. The final report provides a clear summary of:

- Risks

- Industry benchmarks

- Tailored strategies, including asset management and legal solutions.

This enables you to make informed, strategic lending decisions confidently. For a clearer path to secure lending, download our flyer today and see how our Business Assessment Tool can transform your operations.

Need a Mood Boost?

Does the constant chatter about distressed businesses have you feeling a bit blue? Don’t worry, we’ve got just the remedy! Introducing the Resolute Hype Playlist on Spotify, curated especially to help you destress and recharge. We understand that discussions about bankruptcies and receiverships can sometimes weigh heavy—so let this collection of upbeat tunes help lift your spirits and turn your day around. Hit play and let the good vibes roll!

About Resolute’s Restructuring on the Rocks

Originally launched as The Resolute Index, this enhanced report offers a comprehensive analysis of Arizona’s workout industry trends. “Restructuring on the Rocks” delves into the nuances of workout dynamics within Arizona, comparing these findings with regional trends across the Rocky Mountain West—including Washington, Oregon, Idaho, Montana, Wyoming, Nevada, Utah, Colorado, California and Arizona. This newsletter not only tracks significant trends in bankruptcy filings and the broader business climate but also brings you the latest on innovative tools, company announcements, and other developments at Resolute.

About Resolute

Since 2008, Resolute has been providing solution oriented financial advisory services including corporate renewal, receivership, forensic accounting and litigation support. Resolute has provided services in 36 states across the country and has been involved with more than 500 distressed engagements with assets totaling over $7 Billion. Resolute’s ability to maximize value in entangled business situations has been utilized by financial institutions, corporations, law firms, state courts, and federal courts.

The information and any statistical data contained herein were obtained from sources that we believe to be reliable, but we do not represent that they are accurate or complete, and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice.