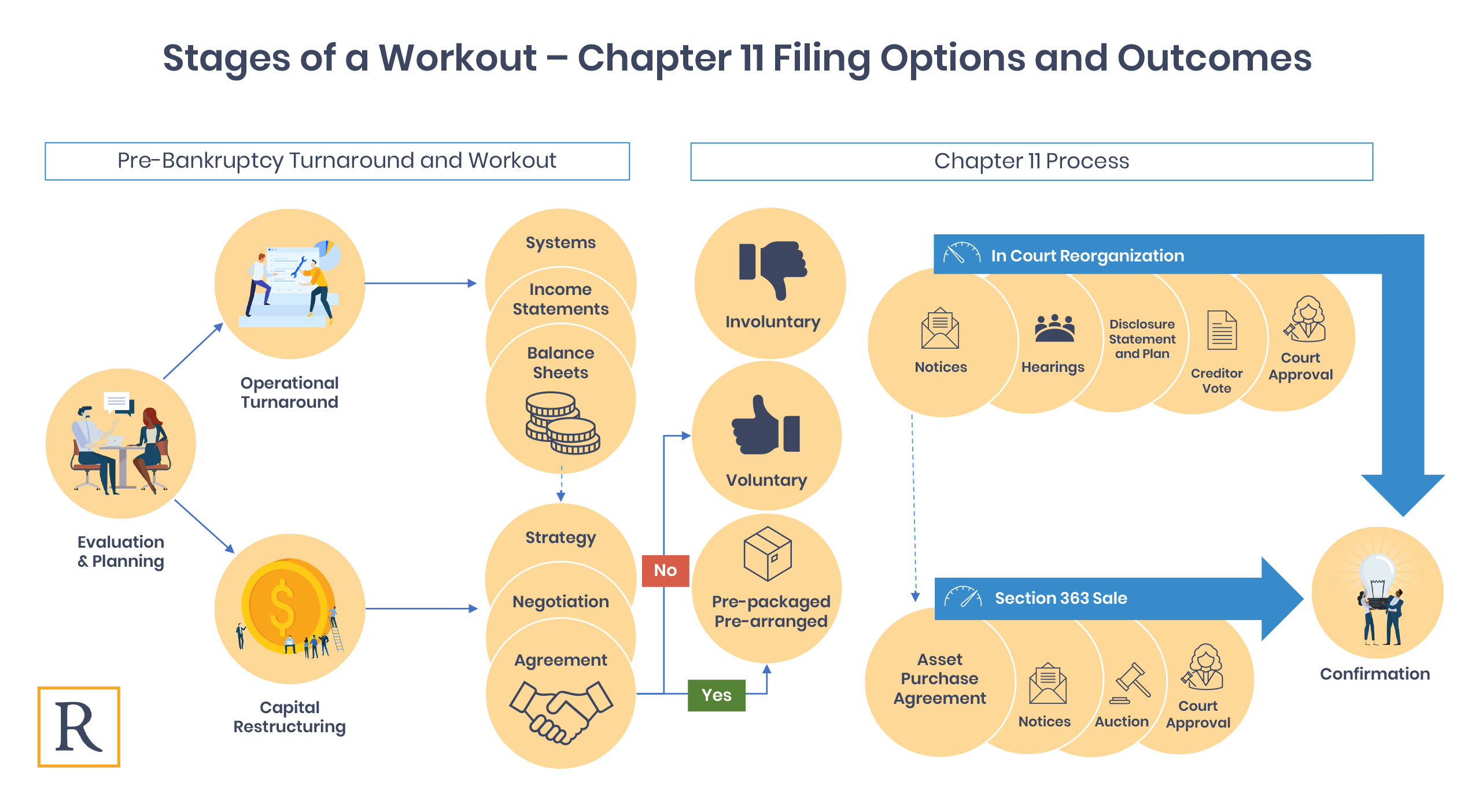

Understanding restructuring options can be complex. What happens when a Chapter 11 filing is pursued? We’ve put together a helpful guide to understand and contemplate what happens before a Chapter 11 filing, and what happens when the process begins.

Key takeaways:

- When facing Chapter 11, there are generally three scenarios:

- Reorganization and restructuring of debt, maintaining ownership structure.

- Selling the business or assets, known as a 363 Sale.

- Liquidation or the termination of the business entirely.

- The best possible outcome will often be restructuring. It’s important to understand all the variables and have your financial house in order, so to speak. Know your financials, your strengths, and your weaknesses.

- While restructuring may be an ideal goal, 363 Sales are often going to be the quickest resolution. Understanding the timeline your scenario requires is key.

- Consensus will be required from a variety of stakeholders: major creditors, lenders, landlords and more. Ultimately any Chapter 11 Plan is contingent upon court approval.

Need Guidance?

The best chance for success when facing a Chapter 11 scenario is to have trusted experts and advisors on your side to provide guidance and an unbiased evaluation of the circumstances.

With Resolute having proven experience as Chapter 11 Trustee, Chapter 11 Liquidating Trustee, and Chief Restructuring Officer, we’ve provided solutions for every situation.

Looking to have your problems solved? Reach out to learn more and talk with an experienced turnaround professional.